1322 Legacy Strategies - Authority Brochure

To save as PDF, use your browser's Print function (Ctrl/Cmd + P) and select "Save as PDF".

Your Legacy, Secured.

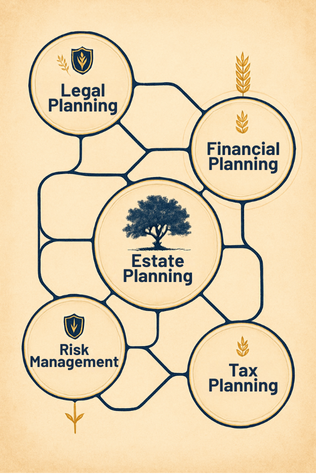

A definitive guide to holistic, tax-savvy estate and retirement design for those who build for generations.

Brad Raschke

Founder & Lead Strategist

Retirement Can Feel Like a High Wire Act.

We Provide the Net.

Brad Raschke understands that the first day of retirement can feel like stepping onto a high wire with no net. After a decade helping more than 500 families handoff their legacy, he’s learned that the real threat isn’t market crashes alone—it’s unmanaged taxes, clumsy trusts, and sequence-of-returns risk draining accounts just when withdrawals begin.

Grounded in Austrian-economics skepticism of centralized money and armed with the Nelson Nash Institute’s liquidity tools, Brad built 1322 Legacy Strategies so retirees wouldn’t have to choose between growth and control.

Brad’s team combines advanced tax mapping, trust coordination, and—where appropriate—private-contract cash-value policies to:

- Reduce Required Minimum Distributions by up to 40% through strategic Roth conversions.

- Create “permission slips” for higher lifestyle spending by adding guaranteed income floors.

- Ensure heirs inherit clean entities, not probate nightmares.

Fast Facts

Name / Role

Brad Raschke, Founder & Lead Strategist

Core Specialty

Tax-efficient income planning · Trust & estate architecture · Liquidity engineering

Designations

Authorized Infinite Banking Practitioner · 10+ yrs fiduciary-style planning

Primary Client

Pre-retirees & retirees age 60–75

Guiding Philosophy

Austrian economics · Biblical stewardship (Prov 13:22)

Flagship Outcome

Clients cut lifetime taxes, lock in predictable cash-flow, and pass assets—not headaches—to heirs.

Brad Raschke

Founder & Lead Strategist

Our Guiding Anchors

Our strategies are rooted in timeless principles, not fleeting market trends. We build your plan on a foundation of economic prudence and stewardship values.

Core Question

“How many unnecessary dollars will the IRS and long-term-care costs siphon off before your grandkids ever see a penny?”

Biblical North Star

“A good man leaves an inheritance to his children’s children.” – Prov 13:22

Economic Lens

Austrian School—fight hidden inflation taxes with real liquidity and contractual guarantees.

Retirement Rule

The first 10 years of withdrawals decide 80% of a portfolio’s lifetime success.

Brad Raschke

Founder & Lead Strategist

Proven Strategies & Real-World Results

Our Core Differences

Tax Drag Reduction

Income Certainty

Estate Clarity

Liquidity on Demand

Generational Stewardship

Holistic Coordination

Client Success Stories

Real families, measurable wins, faith-aligned planning.

The Sequence-Proof Couple

Age 67 & 65 · $2.1 M in 401(k)/IRA assets

“Brad’s tax map and partial Roth ladder trimmed $408,000 off our future RMD bill. A joint-life income annuity now covers the Social Security gap so we can delay both benefits to age 70...”

The Business-Exit Safety Valve

HVAC owner (64) selling for $4 M

“Brad paired an installment sale with a charitable remainder trust and an IBC liquidity pool. Result: zero capital-gain panic, a self-funded LTC plan, and we tripled our giving capacity.”

From Red to Green Scorecard

Chris & Sarah (TX) · $1 M pre-tax, no LTC, no trust

“Our scorecard was bleeding red. Twelve months later, proactive tax moves and legacy life insurance transformed our estate to $2.3 M of protected, stewarded wealth. We finally feel bullet-proof.”

Your numbers will differ, but the process is the same: data-driven insight, faith-aligned strategy, lasting legacy.

Brad Raschke

Founder & Lead Strategist

Our Vision & Your Peace of Mind

Why We Act as Your "General Contractor"

Coordinating CPAs, attorneys, and advisors shouldn’t be your problem. 1322 acts as the central point of contact so every part of your financial plan talks to the others, eliminating costly gaps and oversights.

Our Commitment for the Next 3–5 Years

- Launch an AI-indexed knowledge vault for clients—plain-English answers on demand.

- Mentor 5 younger advisors in stewardship-based planning to widen our impact.

- Facilitate $100M+ in tax-efficient charitable gifts via donor-advised funds and CRT strategies.

The Stewardship Thread

Brad’s stewardship worldview was forged watching his grandfather quietly fund nine grandchildren’s college educations and plant ministries. Today Brad channels that legacy by freeing retirees from avoidable taxes and interest so they can fund life-giving causes—whether that’s a first-generation college grad or a global mission.

“Every dollar we keep out of the IRS’s pocket and Wall Street’s fees is a dollar that can bless a grandchild or feed a village.”

— Brad Raschke